“Today’s Sacrifice: Tomorrow’s Triumph”

BUDGET SPEECH FOR FISCAL YEAR 2021/2022

Hon. John Briceno

Prime Minister and Minister of Finance, Economic Development and Investment

Belmopan, Belize

Friday, April 9, 2021

Introduction

Madam Speaker,

I rise to present Government’s Estimates of Revenues and Expenditure for the Fiscal Year 2021/2022, and to report on the performance of the National Budget for the current Fiscal Year 2020/2021.

This is the first budget for the 5-year cycle 2021-2025, the first also for my Administration — coming to office, as we did, on the thrust of a ‘wave election’ on 11th November 2020.

That extraordinary mandate was ratified by an almost unmatchable margin less than four months later, in the municipal elections of March 3 of this year. With just 31 additional votes in the mayoral race and 23 votes in the elections for counsellor in the twin towns of San Ignacio/Santa Elena, our Party would have secured 67 of the 67 seats available instead of 65.

Along with these historic endorsements have come immense responsibilities, which obligate us to rise to the demands of the Constitution, our Manifesto, and the national interest. And it is to that national interest that this revenue-collection and spending process -– the Budget process — must do justice.

That this Budget Presentation comes at a juncture of unparalleled national crisis is indisputable.

Belize is facing her most severe economic, fiscal and debt crisis.

And though the health crisis caused by Covid-19 is currently in remission, with the virus’s spread largely controlled, the recent ‘resurgence’ that is being seen in Europe, and closer to home, in Antigua and Barbuda, and elsewhere, should caution us that our substantial progress can quickly be reversed. To state the obvious, Madam Speaker, the virus is ever present, the risk to Belize and Belizeans remains real. We must remain vigilant.

How we navigate through this extraordinary crisis; the extent to which discipline, sacrifice and solidarity prevail; the efficacy of our home-crafted Medium Term Economic & Fiscal Recovery Plan, will, in sum, determine the well-being of our people, the resiliency of the public finances and the durability of the value of the Belizean dollar.

It is worth noting that the amount required to meet the demands of our constituencies typically outpaces budget funding even in normal times. The mismanagement and mess we inherited, however, has widened the gap between these two amounts to an almost unmanageable degree.

At the outset, allow me to recognize the many contributors to this delicate, consensus-building budget process, starting, naturally, with my Cabinet and Parliamentary colleagues who have confronted this unprecedented national emergency with poise and with patience.

And I thank also the social partners, with whom there have been genuine consultations. I acknowledge the Belize Chamber of Commerce and Industry, the Belize Business Bureau, the Council of Churches and the NGO community. I applaud the Joint Unions for their extensive contributions as well as those many public officers whose execution of their duties had an impact in ways small and large upon the participatory exercise of composing this budget.

When all is said and done, the National Budget is really a Budget about all the people — working people and businesspeople -– because from its birth to its burial, the National Budget touches all Belizeans in some way or the other. And this budget in its plain speak, realistic goals and honesty will usher in a new time in our national development and with an optimism that the shared sacrifices we make today, will result in all of us being able to triumph tomorrow.

REGIONAL AND DOMESTIC CONTEXT

Except for the opportunity to vote out the UDP Government, 2020 is a year most Belizeans would rather forget. What was designated in the Chinese calendar as the Year of the Rat turned out to be the Year of the Black Swan, with the onset of an unforeseeable, once-in-a-century global health disaster.

From this rolling public-health-cum-economic catastrophe, there would be no safe harbor.

- According to the IMF, the global economy shrank by 3.5 percent.

- Central America’s fell by 6 percent.

- The tourism-dependent Caribbean economies sank by 10 percent.

The output generated by Belize’s economy, 40 percent of which was previously lifted by tourism’s propulsion, nosedived by 14 percent, a steeper fall than all except for 5 countries, 2 of which are fellow Caribbean, tourism-dependent states.

With an economy already firmly in recession, having contracted all of 2019, the pandemic quickly turned the UDP recession into a full-blown depression. In addition to the thousands unable to find work before Covid-19, 64,000 more Belizeans lost jobs, thousands of businesses pivoted to emergency mode after a mandatory lockdown, and the Government, hamstrung from years of excessive borrowing, mismanagement and distracted by a pre-election feeding frenzy, could do very little, except, of course, to borrow, borrow and borrow more. By none other than Mr. Barrow himself.

I digress, for just a moment, to lament the loss of life caused by the Covid-19 virus — 318 Belizeans to date, a loss far more regrettable than the loss of livelihoods. We continue to mourn these fallen Belizeans who succumbed to Covid-19 and offer prayers for the comfort of their families and loved ones. On this side of the House, we grieve for our colleague and friend from Corozal Bay, the late David Vega, who left us far too early.

To the new Representative from Corozal Bay, the Hon. Elvia Vega-Samos, Dido Vega’s sister, we offer first our solidarity and of course our congratulations and full support.

Madam Speaker it is undeniable that the UDP Administration turned over to my Government an economy that was far worse than a mess, they turned over an economy that was in veritable tatters: a busted budget for this fiscal year that has required average borrowing of more than $1 million per day, a soaring level of unemployment that is afflicting 29 percent of the workforce and a total public debt that’s the sixth highest in the world.

NOT even those on this side of the House could have imagined these possibilities.

The sixth most indebted nation, the fifth most severe depression of 2020, our status as one of only 13 countries on the planet that do not even appear in Transparency International’s Corruption Index, hence leaving us without a ranking – that is the legacy of the UDP.

This is the extent of the national decline which my Administration begins to reverse with this, our first National Budget proposal.

DOMESTIC ECONOMY AND FINANCIAL SECTOR DEVELOPMENTS

As a prelude to revealing Government’s overall Medium Term Recovery Plan, it is important to share some snapshots of the domestic economy as well as the financial sector. While the overall economic output fell by 14 percent, this drop was not uniform. Clearly, the service sector was hardest hit, with hotels and restaurants crashing by 60 percent and the yields in the overall tertiary sector dipping by 17 percent.

Consequent to that fall, output in the secondary sector, where manufacturing and construction are recorded, fell, but not nearly as precipitously, with a decline of 1.8 percent. Sales of such products as flour and beer, which are tied to tourism, faltered, but hydroelectricity rebounded handsomely, rising by 15 percent, year on year for 2020.

The primary sector’s outturn decreased by 2.4 percent, impacted largely by a 27 percent fall in fishing activities. Positively, agricultural output posted a positive performance, if just slightly, with a 0.5 percent increase, due largely to a rise in the revenue we earned from the sales of our southern staples, citrus and banana.

Some crisis markers, at least temporarily, moved in unexpected directions — for example, the balance of trade, balance of payments and reserve position of the Central Bank. Imports fell for the year 24.5 percent, outpacing the fall in exports, and with remittances rising and profit repatriation falling, the balance of payment deficit narrowed from 9.3 percent of GDP to 6.9 percent. Government access to and rapid drawdown of borrowed funds expanded the import cover of the reserve position modestly, from 4.1 months in 2019 to 5.2 months in 2020.

Relatively speaking, the domestic financial system maintained its solid standing. Excess statutory liquidity totaled $420.3 million at the end of last year, non-performing loans totaled 5.8 percent, and the weighted average lending rate stabilized at 8.5 percent.

In its recent Article IV Statement, the IMF concluded that “the banking system entered the pandemic with abundant liquidity and strong capital buffers,” a rare positive assessment in an otherwise dire report by the Fund.

A commitment to retaining strong fundamentals has not deterred the Central Bank from cushioning vulnerable borrowers; in fact, the Regulator has recently extended the forbearance framework that allows commercial banks to extend flexible repayment terms for customers. Last April, the Central Bank had also lowered the statutory liquid asset and cash reserve requirements, and adjusted select provisioning protocols, all with the goal of softening the edges of the crisis for bank customers.

As a recovery picks up steam, the levels of asset quality, of non-performing loans and of bank capital will be closely supervised by the Regulator.

FISCAL YEAR 2020/2021 PERFORMANCE

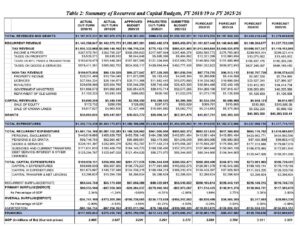

Summary Estimates for 2020//2021

Madam Speaker,

The projected outturn for the fiscal year ending 31st March 2021 is dismal, despite our back-breaking efforts since assuming office to halt the flow, the red ink — no pun intended — by limiting spending to priority areas and eliminating waste.

Revenue Performance in 2020/2021

Total recurrent revenues and grants are projected to fall by 28 percent, exactly twice the level of the overall economic contraction for 2020. I repeat, for emphasis: for every dollar Government expected to collect, it actually collected 72 cents.

And thus, friends, the actual amount that will be going into the nation’s pocket is likely to be, not the $1.239 billion that we expected to collect, but a considerably lower $899.6 million. Tax revenue derived from the major sub-categories of income, profits, property and international trade and transactions, declined at a rate that, for the most part, mirrored this average drop of 28 percent — the exception being the GST, which fell by 32 percent. Under the category of non-tax revenue, the fees collected for licenses fell by 52 percent while the capital revenue report projects the sale of crown lands to substantially exceed the budgeted amount.

Expenditure Performance in 2020/2021

On the expenditure side, total spending fell by only 15 percent, far below the 28 percent drop in revenue. This is the crux of the exigency we face, and it cannot be over-emphasized. The amount we have been collecting fell by a significant amount — almost a third of what we used to collect. But we’ve only advanced halfway in our efforts to reduce our spending to match the huge drop in what we earn. In other words, we’ve only moved halfway toward the point where we need to be, even before factoring in debt service and principal repayment. That’s the point where every dollar we spend is what we actually have – a balanced budget.

The halfway point we are trying to bridge is a precarious position, fraught with risk. In a figurative sense, our financial face mask, in these Covid times, is halfway between our nose and our chin. It’s a dangerous level of risk exposure that must be addressed.

The sectors in which total spending fell to levels lower than the amount budgeted included Goods and Services, with the amount spent on these two being clipped by 31 percent; Pensions, which fell by 14 percent, Subsidies and Transfers, which were reduced by 31 percent, and debt service payments, which were reduced by 54 percent. This decrease in debt service spending, the most substantial reduction, reflects the capitalization of the Superbond coupon payments which was agreed to by bond holders in August of 2020.

Notably, amidst the cuts and reductions in spending in various sectors, wages to public workers actually rose by $11 million, or 2.5 percent.

Overall capital spending exceeded budgeted levels by 5 percent, rising to $294.8 million from a budgeted level of $281.7 million.

In summary, overall, for every dollar Government expected to spend, it actually spent 86 cents.

Outturn for 2020/2021

The primary deficit and overall budget deficit are expected to be -8.51 percent of GDP and -10.21 percent of GDP, respectively, substantially exceeding the budgeted levels of -0.89 percent and -4.58 percent, respectively.

In dollar terms, the last Administration sought approval to borrow $253.7 million for this budget but would actually have borrowed by fiscal year’s end, some $370 million. As a result of the capitalization of the super bond interest payment, that $370 million is a figure that is $53 million less than the amount of borrowing that would have been otherwise required. In other words, even without the super bond payment, the last UDP Budget borrowed 46 percent more than was authorized by Parliament last March.

For every dollar of UDP spending in the final year of that administration, a monstrous 31 cents was borrowed. And for every dollar spent under this budget, 54 cents (more than half) will have been directed to wages and pensions; 25 cents on capital projects and 15 cents on payment for goods and services.

Rather than curtailing borrowing as the debt levels rose, the last administration, I emphasize, ramped up the borrowing to levels that are simply beyond belief: in the FY 2018/19, budget borrowing represented 10 cents of every dollar of recurrent revenue; then in FY 2019/20, that figure more than doubled, with 24 cents of each collected dollar being borrowed. And this year just ended, 43 cents of each dollar of our country’s revenue was borrowed.

Can there be any doubt that the deluge of UDP debt was deliberate, pre-meditated and designed in equal parts to disguise the underlying decay to the public finances, to fund a pre-election orgy of hustling, and to sabotage their successor?

Their disgraced brand of costume party politics, the short-sighted lack of concern for the next generation, has pushed all of us to the very edge of default, the erosion of our exchange rate and national disgrace.

PUBLIC DEBT

For purposes of full disclosure and for the record, let me elaborate on this most important subject of public debt. For the last 13 years during three UDP administrations, our country has been hurtling toward a debt crisis, heedless to the grave perils of over-borrowing, impervious to the generational poverty trap that unsustainable public debt lays for our people. Except for the Opposition, very few sounded the alarm, even as the then Government was obviously borrowing to fund regular wages, wage increases and increments.

The scale of just how much the Government owes today is breath-taking: the equivalent of $10,000 for every man, woman and child; $50,000 in debt for each family of five; the inconceivable total sum of $4.2 billion -– that’s the number 4 followed by nine digits.

For the average Belizean citizen, whose annual income under the UDP withered to $5,800, a level not seen since 1992, such unearthly indebtedness is unconscionable.

For the nation state of Belize, this magnitude of public debt, some 130 percent of the country’s entire annual economic output, places us, as I indicated earlier, as the sixth most indebted country in the world. Of all countries, only Japan, Greece, Venezuela, The Sudan and Lebanon have a higher public debt ratio than Belize.

Like a member of a family who returns home to discover that his or her sibling who was in charge of handling the family finances has not only squandered the savings but owes every bank and loan shark in town, my Administration took office inheriting a public debt position that has us teetering on the brink of sovereign delinquency, our assets mortgaged or sold, our precious currency peg perilously at risk.

As it now towers over us, here is a breakdown of the public debt:

$872 million is owed to our bilateral lenders, 55 percent of which was borrowed under the Petro Caribe Program with Venezuela; while 34 percent of this amount is owed to the Republic of China on Taiwan and the small remainder to other friendly countries.

$794 million is owed to multilateral lenders, with 36 percent owed each to the Inter-American Development Bank and the Caribbean Development Bank, 17 percent to OPEC, 7 percent to the World Bank and the balance to international financial institutions such as CABEI and the EIB.

$1.168 billion is owed to external commercial creditors, 97 percent of which represents the so-called Superbond, while the remaining $60 million is a domestic US dollar bond issued by the Central Bank of Belize in 2020.

And finally, some $1.35 billion is owed to domestic creditors, the largest portion, about $561 million or 41 percent, is owed to the Central Bank of Belize while domestic banks are owed some 28 percent of Government’s local debt stock.

At present, therefore, two thirds of Belize’s public debt, approximately $2.8 billion, represents external loans that must be repaid with foreign currency.

The average interest rate on external debt is 4.2 percent and on domestic debt is 2.7 percent.

Looking back, history will not be kind to those who maxed out the national credit card. It is no exaggeration to posit that the highest point in our country is no longer The Victoria Peak; rather, the highest point is now at the top of this debt mountain the UDP left for us to scale.

Looking forward, this Government has assigned the highest priority to debt sustainability, with a goal of reducing the debt to GDP ratio to 85 percent by 2025 and to below 70 percent by 2030. To achieve this ambitious and necessary goal, my Administration is already taking the following steps:

First, a Debt Management Unit comprised of external and domestic advisors, with participation at the highest levels of the Ministry of Finance and the Central Bank of Belize, has been mobilized. During the recent Article IV discussions with the IMF, the Unit outlined the debt management elements of Government’s Medium Term Recovery Plan, laying out its roadmap for achieving sustainability and for restoring prudence to the public debt, some of which I will now highlight.

Second, negotiations to restructure the Superbond have commenced. In good faith, Belize invited the formation of a Creditor Committee on 19th March and proposed new terms for this obligation, which at US$556.5 million, represents 28 percent of outstanding overall debt and 40 percent of external debt. More importantly, the current interest payments, set at a coupon rate of 4.9375 percent, or $55 million annually, constitute 45 cents of every dollar budgeted for debt service in the Approved Budget for FY 2020/2021.

In the proposed Budget for FY 2021/2022, there is a provision for the payment of a coupon consistent with the offer we have made to bondholders. That next coupon is due on 20th May 2021, by which time I would expect that negotiations would have been concluded. Last year, as Leader of the Opposition, I expressed the view that capitalizing this year’s interest payments, thereby increasing the amount of debt outstanding, was a self-defeating approach.

To ‘extend and to pretend,’ as our predecessors did on three occasions during their debt negotiations in 2013 and 2017 and with last year’s capitalization, is, in our considered opinion, both unwise and unviable. This was also the unanimous verdict of a recent Debt Sustainability Analysis conducted by the IMF. Therefore, securing near-term cash flow relief, as well as overall principal reduction, is the unambiguous basis upon which the current negotiations must, in our view, climax.

Third, an active review is ongoing with regard to other classes of public debt, with the exception of the already concessionary multilateral loans, so as to carve out for the country some short-term fiscal space, whether by means of write-offs, payment deferments, coupon reduction or discounted buyouts.

And fourth, Government’s gross financing needs –- the amount of financing support required over the next 5 years within the construct of our Active Recovery Plan -– is projected to be about $1 billion. Diligent debt management will ensure this deficit funding is sourced on optimal terms. Already, with the support of our exceptional ally, the Republic of China on Taiwan, a new, 4-year Memorandum of Understanding has been formalized between our two countries, guaranteeing critical grant and loan budget support, commencing with a first payment of $80 million for this Fiscal Year.

Now let me quote the words of the IMF in its recent Article IV Concluding Statement: “The key policy imperative for Belize is to restore public debt sustainability and strengthen the currency peg.” This recommendation by the IMF could just as well have been taken from our Government’s home-crafted Recovery Plan. In the same fashion that Belizean families and businesses must be discerning in managing debt, borrowing only as a last resort and for the most urgent purposes, restricting themselves to loan amounts that can comfortably be paid back and to terms they can meet, and most crucially, leaving some room to borrow when the inevitable emergencies arise, so too must the Government approach its constitutional privilege to borrow in the name of its citizens.

In short, Madam Speaker, public debt must be sustainable, and it must be managed for the public good.

THE RECOVERY PLAN

Madam Speaker,

Before outlining the broad contours of the new Budget that I table today, I wish to outline the rationale and the framework for the wider Medium Term Recovery Plan.

Erroneously, in some quarters it has been suggested, perhaps assumed, that the salary adjustment is the sole pillar upon which the fiscal recovery rests.

Nothing could be farther from the truth.

The salary adjustment is necessary, but it is no fiscal elixir; that alone is far from sufficient to reverse the public finance morass left behind by the last UDP Administration.

Painful as it surely is, the $60 million in salary adjustments and the $20 million foregone for increments and allowances in this Budget is one step in the hard slog back to fiscal fitness.

A correlative to this cost curtailment step is the drastic reduction in this Budget of spending on goods and services, which is being slashed by $78 million compared to the previous budget.

A second step is the reduction in interest payments which for this budget is being programmed at some $53 million less than what was allotted for the previous fiscal year. I have already addressed that subject of public debt management, in a substantial fashion, earlier in my presentation.

The third step must be the augmentation of revenues. As Government and the Joint Unions have agreed, this can be achieved first by sparing no effort to collect current taxes from all sources from whom such taxes are due, and simultaneously, by ensuring that legitimate, outstanding taxes are recovered immediately.

Whether current tariffs will suffice, without the need for incremental revenue measures, will depend on those who pay and those who collect. To those who evade the tax system, thereby imposing a disproportionate burden on the rest, I signal today, without hesitation, that the state’s enforcement agencies will hereafter adopt a muscular approach to revenue collection and enforcement.

As a fourth and final step, Government and all stakeholders, especially the public service and the private sector, must together seed and reap higher, more equitable economic growth. Enabling investment, both domestic and foreign, is of the highest priority for this Administration, and I will outline later this morning some specific structural reforms we will adopt so as to foster the conditions for high growth.

These four essentials form a carefully calibrated composite for our Recovery Plan: spending reductions, revenue enhancements, comprehensive debt restructuring and above-average economic expansion, all intertwined to underpin a renaissance of sturdy public finance.

I am compelled to signal one other major imperative of our Recovery Plan, and that is the urgent need for public pension reform. Noncontributory pension payments in the budget have neared $100 million for a single year. That level of spending is simply untenable. When we left office in 2008, the annual cost of pensions was $38 million. Today that has virtually tripled. Government must move now to transform the public pension scheme to a contributory structure, either standing on its own with payments from both employer and beneficiary, or a merger of the public pension program and the Social Security System.

To be completely clear, this Recovery Plan is not without its downside risks, some risks recognizable as being so grave as to imperil the Plan itself. If, for example, some variant of Covid-19 defies the vaccine campaign and tourism fails to gradually recover; or if hurricanes, floods or droughts return in the near term to extract another substantial economic toll, then all bets would be off and a more aggressive recovery program would be required.

For this year, the IMF forecasts only a modest GDP rebound of 1.9 percent, with a steep upswing of 6.4 percent projected for 2022. Their prediction is that a return to pre-Covid economic activity will not occur until the FY 2024/2025 period. While we are more optimistic, contingency plans will be at the ready in the event that the rebound is protracted.

I am confident, though, that if we all adhere to the Recovery Plan, if we achieve our revenue and spending targets, if we restructure and re-profile the public debt and if we can catalyze sustained economic expansion, together as a nation we would have averted default and the depreciation of our dollar. We would have protected thousands of public sector jobs and retained our fiscal sovereignty.

In subsequent years, once an economic recovery takes firm root, once the debt is on a stable footing and primary surpluses are being achieved, then increments can be restored and targeted spending, particularly on the more ambitious goals of Plan Belize, can expand.

As Prime Minister, I control the behavior of neither viruses nor the climate. What I propose, what we are elected to coordinate, is a credible, time-bound Recovery Plan.

Renewal, reform and rebound are the lodestars of this Administration.

FISCAL YEAR 2021/2022: THE NEW BUDGET

Summary Estimates for 2021//2022

Madam Speaker,

Assembling any budget is always a high-wire balancing act.

There are limited funds and virtually unlimited calls for spending.

Assembling a budget in the midst of a pandemic and economic depression is excessively rigorous if, as I insisted, we conform to these general requirements:

First, that the budget moves the economy decisively to a sustainable foundation, so that we can reduce the deficit, and thus lower the need for borrowing. These FY 2021/22 forecasts of revenues and expenditures are tethered to reality, not to political showmanship. And this is belt-tightening that is necessary, I reiterate, because of the UDP mess that we have inherited.

Second, that the adjustments made in the movement towards a balanced budget are spread as evenly as possible and are shared equitably so that no one sector or group of people suffers disproportionate pain. Thus, it will be evident that reductions are being made to all recurrent spending lines — to wages, to goods and services, to transfers and subsidies and to debt servicing payments, in as tolerable proportions as possible.

Third, that capital investments — both Capital 2 and Capital 3 outlays — be preserved, and, where feasible, augmented, since this category represents the only form of stimulus that Government can afford at this time. Public spending represents 39.2 percent of national output, making our capital investment program the single leading indirect provider of private sector jobs, in addition to the employment of those who are directly on the public payroll — a payroll that is also the single largest in the economy.

And fourth, that priority be given to spending in the areas of health, poverty mitigation, education, citizen security, rural development and of course, the maintenance and development of the infrastructure of our National Logistics Network. Giving everyone a fair shot at prosperity, more so because of the inequities in society that the extant crisis has compounded, is our urgent duty. A recent regional study has illustrated that failing to do this, will “raise polarization, erode trust in government or [cause] social unrest.”

Upon this principled scaffolding, we proceeded to build the Budget for this Fiscal Year, which projects total revenues and grants of $1.030 billion, an increase of 14.5 percent compared to the projected outturn for FY20/21.

Estimates of Revenue and Grants 2021/2022

Of recurrent tax revenues,

- $247.5 million will come from income and profits,

- $6.4 million from property,

- $137.7 million from international trade and transactions,

- And $484.7 million from the goods & services

Non-tax revenue will total $81 million, the two notable line items being Royalties, forecasted at $29.4 million, and levies collected by Ministries, forecasted to be $32.6 million.

Capital Revenues are projected to total $5.2 million.

Grants will total $67.4 million, the principal contributors being the Republic of China on Taiwan at $20 million and the UK Government through the Caribbean Investment Fund at $22.5 million.

Estimates of Total Expenditure 2021/2022

Overall expenditure will total $1.204 billion, of which recurrent spending represents $905.9 million and capital spending $298.6 million.

Of recurrent spending,

- $413.7 million will be on Wages,

- $91.0 million on Pensions and Ex-Gratia Payments,

- $175.5 million on Goods and Services,

- $68.4 million for debt serv

I wish to underline the fact that every category of spending will fall compared to last year’s budget.

On the Capital spending side, total investment will be $298.6 million.

Outturn and Financing of the Budget in 2021//2022

At the bottom line is our primary budget balance, which is simply the difference between what you earn and what you spend, before interest charges, and it is the key measure of sustainability. For this year, the Primary balance will be a negative 2.91 percent of GDP or $97.99 million, which is less than half of last year’s 8.51 percent deficit.

The overall deficit is projected at 4.93 percent of the GDP or $166.43 million dollars, and when the $109.3 million in Amortization is added to this number, the level of financing required for this year is 8.4 percent of GDP or $275.6 million.

This financing will be sourced from the following:

- $186.2 million from our development partners on concessional terms; and

- $89.4 million from domestic sources.

Rebuilding Fiscal Operations in 2021//2022

In this Budget, the salaries and pensions of public employees will constitute 64 cents of every dollar collected by Government, and the costs attendant to their work, such as utilities, fuel, travel, etcetera, account for another 18 cents of each dollar. That leaves just 18 cents of recurrent revenue, some $176 million, to make all our interest payments that are due on $4.2 billion of accumulated debt, to fund all capital investment programs and to settle principal repayments.

Rebuilding the edifice of the public finances on solid rock, means that Government has to borrow less each year, starting now with a reduction of almost 2 percent of GDP in overall financing for this Budget.

And this Administration will have an unwavering commitment to a balanced budget, at the primary level, for Fiscal Year 2022/2023 — with the further aim to lift that primary to about 2 percent the following year and by Fiscal Year 2025/2026 to carry forward a primary surplus of no less than 3 percent of GDP.

I am confident that these ambitious targets are attainable, because we did it before: the last two PUP Budgets for Fiscal Year 2006/2007 and 2007/2008 featured primary surpluses of 3.85 percent and 3.25 percent, respectively.

We can do it again.

Before elaborating on the impacts of the new budget, I must restate how critical the role of private enterprise will be to the overall prospects for recovery. Recognizing this, Government recently amended the Central Bank of Belize Act to allow for an earmarked line of liquidity to support business continuity and recovery. I can now confirm that the Central Bank will shortly launch the Covid-19 Emergency Business Financing Program to provide low-cost liquidity to small, medium and large enterprises. Funding will be laser-focused on businesses that address the economy’s two pressing priorities: employment and foreign exchange earnings. The $50 million facility, innovatively designed to share underlying risk with participating financial institutions and funded through a special purpose vehicle that will allow individual and institutional investor participation, will extend liquidity to eligible enterprises at a cost of 5 percent, for 5 years, with supportive repayment moratoriums for both interest and principal. Transparent and based on proper risk assessment, with a loan ceiling for each category of borrower, this program will complement the credit products of the domestic banks and credit unions, amplifying job and foreign currency creation. While we cannot foretell the Facility’s success, if the available funds are distributed evenly across all 3 categories of prospective borrowers, there is the potential to impact 200 businesses and thousands of workers.

IMPACTS OF THE NEW BUDGET

Madam Speaker,

During the upcoming Debate, scheduled for April 22nd and 23rd, I am certain that my colleagues will unwrap the innards of the Budget, Ministry by Ministry.

Without detracting from their thunder, I would wish to accentuate the benefits that this Budget projects:

This Budget will preserve employment for 15,000 public servants, 4,900 of whom contribute to domestic and border security, while another 3,500 serve our over 100,000 students throughout the education system and the other 6,600 are on duty across the multiple departments and agencies of the national Government.

In a sense, these 15,000 public servants have 405,000 full-time customers, who are the other citizens of Belize, as well as many thousands of part-time customers — those who reside in invest in and visit Belize. Their work, paid for by all taxpayers through the appropriations in this Budget, vivifies the State, enabling the quality of life and many conveniences that all Belizeans share.

This Administration has resisted retrenchment and protected the wages of those earning up to $12,000 per year. Thus, no one earning $250 a week or less will face a salary cut thereby ensuring that NO government employee well fall below the $5 an hour minimum wage.

The proceeds of this budget will service our national debt, both interest and principal repayment — presuming that new terms will be agreed upon for the super bond.

To address the principled priorities, I cited earlier as the bedrock of this Budget, here are just a few of the related capital spending considerations:

- $15 million for the continued battle against Covid-19, including testing, personal protective gear, critical care supplies and so forth;

- $10 million for 238,800 additional vaccines to be acquired on discounted terms through the COVAX facility. You see madam speaker we know that an effective vaccine policy is indeed goo economic policy.

- $3 million for the ongoing food assistance program;

- $60 million for the Coastal and Caracol Highways;

- $3.5 million for new housing programs and low-cost housing support; this in partial fulfillment of PlanBelize

- $3 million for improvements to sugar roads and other agricultural roads; so that our goods can go from farm to table.

- $18 million for the ongoing restoration of the Phillip Goldson Highway; because safety matters

- $16.5 million, combined, for improving education quality and delivery and for Digi-Learn because we believe in our plan to develop an education nation.

- $5 million for upgrading of streets and drains nationally, with special allocations for rural and village roads;

- $12 million for climate vulnerability reduction initiatives;

- $17.5 million for ongoing restoration of the George Price Highway;

- $5.5 million for community-based projects executed by SIF and BNTF; to improve rural living

- $6 million for various national security initiatives, as well as for road safety programs;

- $7 million for improvement to the tax collection system so that tax evasion and underpayments can be substantially reduced;

- $4.0 million to extend the Solid Waste Management Network;

- $4.6 million for the new passport system;

- And more than $100 million dollars in additional capital investments designed to foster growth and efficiency, to alleviate the conditions of poverty, and to advance what the eminent labor economist and author Richard Layard labels “life satisfaction.”

All this is in keeping with our promise to build a Belize that works of everyone “Todos Ganamos”.

The well-being of all citizens, which this Budget strives to engender, will, as Layard recently wrote, eventually become totally accepted as the standard way of evaluating social policies and budget priorities.

Tackling this budget, it is important to note, was carried out in a straitjacket because of our predecessors’ proclivity to extravagance, which led them to choose pavements over people, and roads over relief. How else could the UDP justify committing the Government to half a billion dollars, $520 million, on contracts for just 5 roadways -– the Caracol, Sarteneja, and Coastal Roads and the George Price and Phillip Goldson Highways?

$520 million is the equivalent of 4 years of average capital spending, leaving us with little discretionary space for anything else. No space for low-income housing, or poverty relief, or their vaunted pantry, or skills training, or rural development, or stimulus, or anything else.

While in Opposition, we warned that people cannot eat streets and roads.

Nor can half of a billion dollars on roads ease the pain of poverty or a pandemic.

Yet we must remain committed to our progressive agenda, we must, even in these lean days, seek ways to fulfill even partially our commitments to plan Belize.

In this short time in government, we have learnt that if we want to leave the crisis behind it is necessary to stop thinking of economic and social policies as two separate entities. We need not only to invest more in social protection and public goods and services, but also to involve the private sector and civil society, (that is businesses, civil society organizations and citizens) in this effort.

Through the Social Investment Fund, this organization that invests especially in the rural areas of our country, we have and will continue to provide for one of the most vulnerable sectors of our population. This year we will continue our investment through the Basic Needs Trust Fund (BNTF) and the Caribbean Development Bank (CDB) in potable water systems and health posts in several villages that are still lacking these basic human rights. SIF, through the BNTF 10, will also continue to invest in schools for our children in the rural communities. More schools in several villages will be built, expanded, and retrofitted to ensure that we create a suitable environment to develop the educational opportunities for our children while building the foundation of a skilled labour force.

Investment in projects that decrease our vulnerability to climate change will also continue to be a priority for this government. Through the International Financial Institutions (IFI’s), and especially through the Green Climate Fund (GCF) soft loans, and more so grants, are actively and aggressively pursued at the local and at the municipal and national levels to address the climate vulnerabilities of coastal communities and waterways for the most part. Also, the agriculture sector will be assisted with these grants and loan projects, already underway, with institutional strengthening and financial assistance to adapt to the climatic changes and shifting weather patterns.

Through my office, we will continue to support, and bolster the effectiveness of two special programs. The National Aids Commission and Restore Belize that directly work with two very vulnerable and often overlooked sectors of our communities.

The at-risk young men and girls, that daily populate our prison, is a sector of our community that needs special attention. Presently Restore Belize, through one of its programs “the I am Belize Scholarship program” presently has 43 of these special young minds attending various high schools in the Belize district. These young persons are assisted in obtaining a high school education by providing them with full-service attention program to their needs including mentoring and coaching by the Restore Belize staff and assisting with daily needs like transportation and even food costs. This we intend to emulate countrywide recognizing that this is needed in all communities of our country. We must do everything we can for our youth and assist them to become productive members of our society.

Another program of Restore Belize is the Trauma Informed Practices in Schools (TIPS). As it stands it presently only offers capacity development training to teachers in respective schools. The schools, Maud Williams, St. John’s Anglican, and Queen Street Baptist have done trainings in 2019 and 2020. The long-term vision of the programme is for it to be a catalyst for change in the way duty bearers see their role in engaging with children, youth, and the community. Duty bearers are teachers, parents, community leaders including the police. The programme will have several spin-offs that will be specialized to meet the needs of the communities. The long-term plan for this program is for it to also roll out to the various districts as presently its Belize City centered

STRUCTURAL REFORM

Madam Speaker,

Back in January of this year, in a report to Parliament, I recounted that recessionary storms buffeted the real economy of Belize well before the onset of the Covid-19 pandemic. For four consecutive quarters prior to the fourth quarter of 2019, the economy shrank, and even without Covid-19, the striking fact is that our economy shrank during 3 of the last 5 UDP years.

The domestic economy starts in 2021 where it ended 2012 — producing 3.3 billion dollars of value in gross activity. Per capita income, we repeat, is at 1992 levels, shamefully lagging behind almost every regional peer, including Guatemala, El Salvador, Jamaica, Barbados, Grenada and many others.

Here is the evidence that the UDP, long before leaving office, simply gave up on business:

Belize currently has a rank of 135 out of 190 countries assessed by the World Bank for Ease of Doing Business, again, trailing almost every regional peer. When it comes to starting a business, the ranking drops to 167 of 190. Put another way, only 23 countries on Earth are LESS efficient at facilitating the startup of a business than Belize is.

This cannot be allowed to continue.

This is not who we are.

Belizeans are far better than this rank, our natural and human resources manifestly superior to this shoddy station, a station of which the UDP, after 13 years in office, must take ownership.

Our Administration, this Government, pledges, in collaboration with the social partners and the citizenry at large, to spearhead a dramatic transformation of the business environment.

Here is how this will be achieved:

First, our public officers, from security personnel to teachers to service providers, have a personal stake in this transformation. Service standards across Ministries and Departments will determine, directly or indirectly, budgetary success, and that budgetary success will be shared throughout the economy, but also amongst Government’s 15,000-strong team. That is the spirit and the substance of the recent Joint Union consultations.

Ministers, CEOs and Heads of Departments will be expected not only to lead the way, but also to set the example.

Second, a cluster of legislative enhancements will be rolled out during this first year of our Reform Plan, specific to areas such as exchange control regulations, securities and capital markets and company and insolvency laws. Complementing this fresh framework will be an E-governance campaign to enable online access to 90 percent of government services by the end of our first term.

We have also committed to our multilateral partners, that as soon as this emergency abates, the Government will adopt a Fiscal Responsibility Law, with explicit rules moored to public financial management reforms. This framework will address public debt limitations, budget performance targets, correction mechanisms and an inclusive, transparent Fiscal Oversight Council. The Ministry of Finance is also committed to adopting a multi-year budgeting approach, upgrading the Cash and Public Investment Management and instituting fiscal risk assessment.

Third, to spark this exciting era of prosperity — the new jobs, the infusion of foreign direct investment, the unleashing of export potential -– Government must tear down the unnecessary roadblocks to doing business. We have to fast-track the approvals for strategic investments, accelerate real estate-related processes, relax constraints for small and medium size business to operate, pursue private/public partnerships where these can provide capital and know-how, and urgently build up the National Logistics Network.

Many stubborn, structural barriers to growth and diversification must be removed. To remove those barriers, we will have to improve access to credit through the creation of a credit bureau and credit collateral registry; lower barriers to entry into, and exit from, the market; carry out overdue labour market reforms to allow flexible working hours so that businesses can adjust to fast-changing market conditions; and transform education and technical training to equip workers and entrepreneurs with skills that match tomorrow’s economy, rather than yesterday’s.

Finally, the twin maladies of crime and corruption must not be allowed to fester, for they gnaw at the critical core of investor confidence, befouling the overall environment for doing business. Notwithstanding our harsh fiscal restrictions, Government has provided, and I pledge, will continue to provide, the resources for a more vigorous citizen and visitor security strategy, complemented always by a robust social safety net for the vulnerable population.

In addition, I expect that this year, flesh will be put on the bones of The Whistle Blowers’ and The Civil and Criminal Unjust Enrichment Laws — both solemn undertakings agreed upon with the Joint Unions during the recent budget consultations and is in keeping with our manifesto commitment to nurturing the national principles and dignity to public life.

CONCLUSION

Madan Speaker,

Unlike a hurricane, a visible menace allowing those in its path to prepare, then to quickly assess the evident damage and start the rebuilding, this national crisis is different.

What we are addressing is 13 years of UDP-induced foundational rot and decline, capped by the Covid pandemic.

This compromised structure, as full as it might be of underlying potential for greatness, is now being buffeted by a rolling calamity, hitting us in surges, each surge finding us weaker and more vulnerable.

Those before us had no concern for tomorrow.

They left the public finances on life support, with barely a pulse.

The UDP engaged in a splurge with the double windfalls of oil royalties and the Petro Caribe funds — together over $1 billion dollars, which, today could have put $6,000 into the pockets of every working man and woman, if Government could have handed out that money as a stimulus check.

But the oil royalties and Petro Caribe did not quench their thirst: during their 3 terms in office, they borrowed over $3 billion cumulatively —a billion per term — leaving us with this $4.2 billion monster debt howling for repayment.

While in their hands, a generational windfall vanished and from our hands must now come recovery and renewal.

I am confident that our Recovery Plan can turn things around.

We can reverse this decline and restore our tranquil haven.

To do so, all stakeholders have to stop watching one another in a never-ending stare-down and start watching where we want to be in 5 years. At that glorious point of recovery, a few years from now, if we do the right things, unemployment will be in the low single digits, wages will be buoyant and growing, the economy will be humming apace at 4 or 5 percent growth per year, exports will soar like never before, and our dollar will be strong again.

Government’s budget will return to a sustained surplus and the public debt will have been halved, or more.

Plan Belize, our north star, our road map for re-emergence, will bring jobs at livable wages, a renaissance in agro-productive output, the return of investor confidence, land and home ownership opportunities for the disadvantaged, and a return to equitable economic growth.

But we will only get to that prosperous place with national unity, with joint purpose and with ceaseless striving.

The Father of the Nation, the Rt. Hon. George Price, often exhorted us to wake up and work. He summoned us to an untiring defense of the national good. Now, more than ever, we must trail his shining example of unconquerable optimism; and share his vision of a society aroused and attuned to the national interest; of an empowered Belizean people, prosperous and striding stout-heartedly to that better day when we can live out our promise that everybody fi win. We remain convinced that working together and with the guidance of our Creator, this is well within our reach.

Thank you.